Build a Massive Momentum or Value Stock Portfolio From Zero! (November 24, 2015)

11 Hours | Video: AVC (.MP4) 1280x720 30fps | Audio: AAC 44.1KHz 2ch | 2.8 GB

Genre: eLearning | English

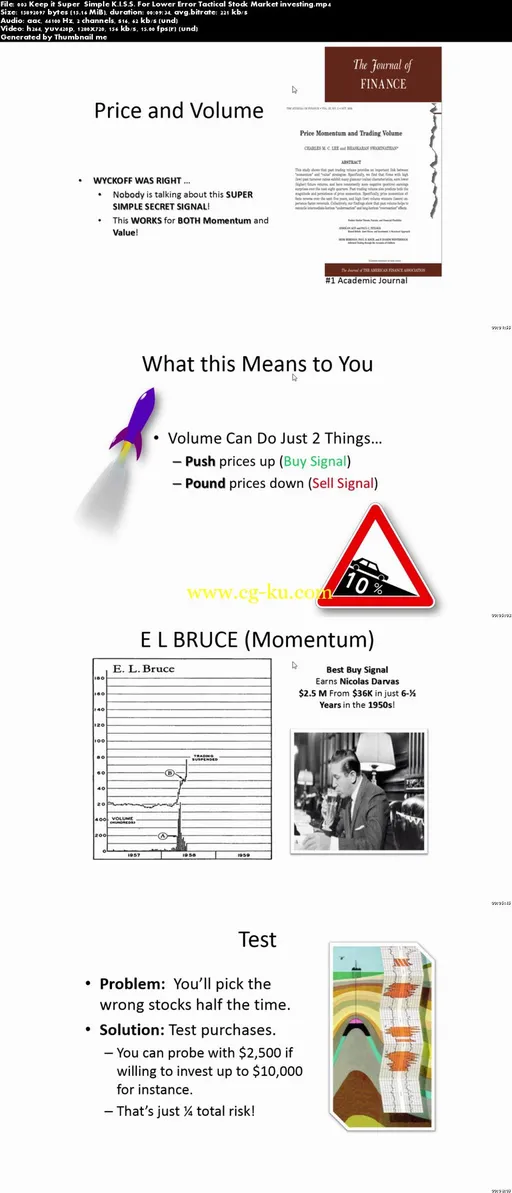

Use this 6 step checklist to spot fortune building value and momentum stocks before Wall Street's Ivy League analysts.

* Lectures 79

ATTENTION: This Udemy Stock Market Investing Course Is Updated Daily!*

*either a buyout, or

*insiders were withholding their shares from the market restricting supply against mounting demand.

What am I going to get from this course?

Over 79 lectures and 10 hours of content!

Use my 6 step process that lands me triple digit windfalls in stocks to amplify returns.

Map out the exact process that led to a $10,739.71 (13.24%) one day profit on January 8th of 2015 - among others.

Follow the USA Today certified path of 5 stocks that would have grown a modest $37,580 investment in 2006 to a staggering $178,206,938 by the end of 2010.

Develop the ability to determine when the odds of success investing in certain stocks are in your favor.

Gain access to personal mentoring with a finance professor and leading researcher at an AACSB accredited business school of a major state university - Dr. Scott Brown.

Know the common struggles stock investors face and the best solutions to overcome.

Develop strategies to overcome under-capitalization, work and family task induced market attention deficit disasters, stock market ignorance, and life routine disruption problems.

Employ filtering methods to reduce daily market information from a firehose blast to a trickle of just the facts that matter most.

Become aware of solutions to miss-calibration problems ranging from severe misinformation to over-confidence.

Shun real estate investments on the basis of appreciation alone - discover the little known truth of why stocks are king.

Filter 3,700 stocks to just 3 most likely to rise based on your independent analysis.

Use my 6 step process that lands me triple digit windfalls in stocks to amplify returns.

Employ refined risk management solutions to time stock market entry and exit.

Know the actual index beating returns to the percentage point of size, value and momentum stock market anomalies - from the most recent and prestigious calculations of the Capital Asset Pricing model.

Master the same forms of financial analysis as analysts living in Beverley Hills and the Hamptons.