How to value a business opportunity

How to value a business opportunity

English | 2015 | mp4 | H264 960x720 | AAC 2 ch | 4 hrs | 955 MB

eLearning, Business, Entrepreneurship | Skill level: All level

Become an expert in valuation expert. Learn to think like a venture capitalist and build a meaningful global business

A comprehensive education on how to value a business opportunity. Learn the standards used by venture capitalists in accessing an investment opportunity and apply these to your next venture. This class has outstanding educational value for individuals interested in entrepreneurship, business in general, becoming investors, becoming co founders and individuals interested in joining a startup where they will get paid in equity. Taking this class will give you the essential tools for a successful creation of an equity and valuation strategy. If you are starting a company with another person(s) than it is highly recommended that all founders take this class before forming a company. This class has been taken by over 20,000 students online and by over 300 startup founders in san Francisco, CA.

What are the requirements?

- An interest in business

What am I going to get from this course?

- Over 23 lectures and 3 hours of content!

- Explain the history of venture capital

- Explain the structure of venture capital

- Explain the difference between venture capitalists and angel investors

- Explain the sources of venture capital

- Explain the difference between nominal and real value

- Explain the difference between buying and investing

- Know how to create a share distribution

- Know the difference between authorized shares and shares outstanding

- Know how to create a cash flow statement

- Know how to calculate the pre money value using the cash flow statement

- Know how to calculate the share price using the cash flow statement

- Know how to calculate the number of shares to issue based on the cash flow statement

- Know how to calculate post money value

- Know how to calculate post money shares

- Explain the impact of investing on equity dilution

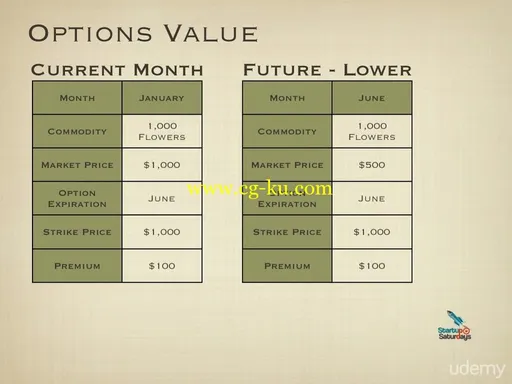

- Explain the concept of options

What is the target audience?

- Investors

- Individuals interested in becoming investors

- Individuals interested in starting their own company

- Individuals interested in buying a company

- Individuals interested in starting a company with someone else as partners

- Individuals who will get paid in equity

- Individuals interested in learning about venture capital

- Individuals interested in working for a startup