Aswath Damodaran (New York University) - Valuation

English | Spring 2014 | mp4, m4v | H264 1440x900, 640x480 | AAC 2 ch 260 kbps | pdf | 7.97 GB

eLearning

This is a class about the valuation of businesses - publicly traded and private. It is a 26-session full semester class for MBAs.

Valuation is a key component of almost every aspect of business. If you run a business, you need to be able to not only assess its value but determine how your actions affect that value, in positive and negative ways. If you are planning on investing in a business or a publicly traded company, you have to estimate its value.

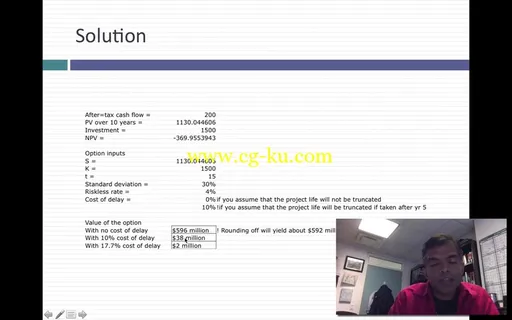

In this class, we will look at the tools that are available to value a business and different ways of estimate that value. We will begin by describing how all valuation models can be broadly categorized into three approaches. In intrinsic valuation, you value an asset or business based on its fundamentals (cash flows, growth and risk). In relative valuation, or pricing, you value an asset based upon how similar assets are priced. In contingent claim valuation, you attach a premium to some assets because they offer a payoff, if something happens.

I promise you three things. One is that I will hold nothing back. I will try to pass on everything that I know about valuation and will not withhold secret sauces or ingredients. The second is that I will inundate you with multiple opportunities to try your hand at valuation, knowing fully well that you are busy and will not have the time to take advantage of all of them. I firmly believe that you learn valuation by doing and want to give you multiple shots at doing so. The third is that I will try to strip valuation of much of the mystique that practitioners and so-called experts have endowed it with, and allow you to look at its simple core.

发布日期: 2014-06-23