Lynda: Income Tax Fundamentals

English | MP4 | 1280 x 720 | AVC ~1556 kbps | 30 fps

AAC | 160 Kbps | 48.0 KHz | 2 channels | 2h 24m | 1.25 GB

Genre: Video Tutorial / Business, Economics and Finance (2015)

Accounting and finance professors Jim and Kay Stice will make filing this year's taxes a bit easier for you by explaining basic taxation concepts and terminology. In this course, they cover topics such as taxable income, tax brackets, average tax rates, withholdings, deductions, and credits, and explain the motivation behind federal tax deductions for mortgages, dependents, and charitable giving. They review the steps involved in filing a personal income tax return, address some of the issues that corporations and small businesses face in filing their returns, and cover the benefits of tax planning.

This is a self-contained introductory course to income tax, but if you'd like more information about accounting in general, check out the Stices' foundational course, Accounting Fundamentals.

Topics include:

The history of income tax

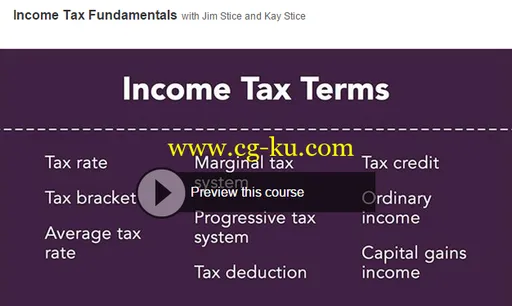

Tax brackets, rates, deductions, and credits

Completing a basic tax return (1040A)

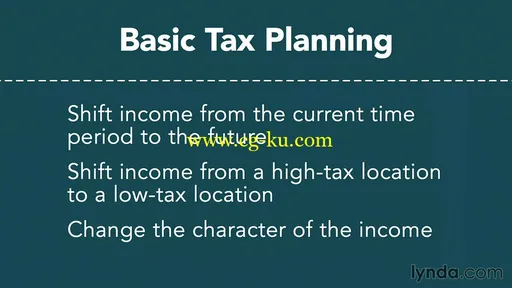

Tax planning

Shifting income

Understanding corporate income taxes

Avoiding tax-evasion schemes

Tax issues for small businesses

Content:

Introduction 1m 53s

Welcome 1m 53s

1. Income Tax Overview 8m 51s

The history of income taxes 2m 16s

Different kinds of taxes 3m 3s

How many sets of books does a large company keep? 3m 32s

2. A Simple Income Tax System 22m 19s

"Taxman" by the Beatles 1m 8s

Tax brackets 3m 34s

Average and marginal tax rates 7m 9s

Tax deductions and tax credits 4m 55s

Ordinary income and capital gains income 5m 33s

3. Common Tax Loopholes and General Income Tax Policy 18m 1s

Who gets tax breaks? 1m 33s

Examples of individual and business tax breaks 6m 27s

The biggest tax loopholes in the US tax code 3m 47s

Income taxes and public policy 6m 14s

4. Completing a Basic Tax Return 30m 3s

Della and Dee Stice doing people's taxes 1m 53s

Joint Form 1040A Adjusted Gross Income (AGI) 9m 32s

Joint Form 1040A to tax payment or tax refund 8m 47s

Itemized deductions 2m 4s

Single Form 1040A Adjusted Gross Income (AGI) 3m 5s

Single Form 1040A tax payment or tax refund 2m 45s

Online tax returns 1m 57s

5. Principles of Tax Planning 16m 24s

Tesla and tax planning 2m 11s

What is tax planning? 2m 24s

Strategy one: Shift income from one time period to another 4m 46s

Strategy two: Shift income from one pocket to another 4m 12s

Strategy three: Change the character of the income 2m 51s

6. Corporate Income Taxes 14m 55s

How large are corporate income taxes? 2m 12s

Business structures 4m 42s

General corporate income tax issues 4m 51s

Multinational corporate income tax issues 3m 10s

7. Income Taxes: Planning vs. Evasion 11m 29s

US income tax on income from foreign countries 1m 53s

Common tax evasion schemes: Refusing to file, understating income, and hiding income "offshore" 4m 8s

Common tax evasion schemes: Claiming personal expenses, paying above-market wages, and classifying workers incorrectly 5m 28s

8. Common Income Tax Issues for Small Businesses 13m 11s

Tax issues for small businesses 1m 21s

Keep good records, don't hide income, and deduct only reasonable business expenses 5m 36s

Employee vs. contractor, business structure, and tax advisors 3m 35s

Is your goal to minimize your income taxes? 2m 39s

Conclusion 7m 41s

Taxes can be complex, but you have the basic tools 1m 40s

Review 4m 29s

Concluding income tax advice 1m 32s

发布日期: 2015-04-29