Tax Assistant for Excel是一款excel插件,用於计算联邦个人收入税收入税计算Excel助手是一个为Microsoft Excel自定义应用程序需要Microsoft Excel的书面和97/2000/XP/2003/2007。

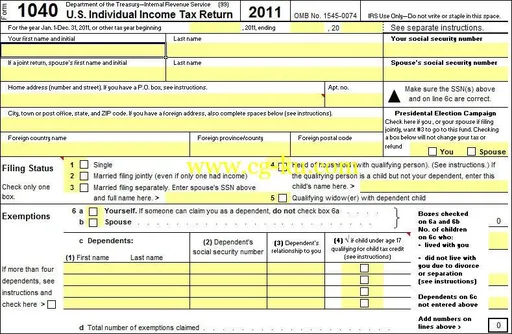

它简化了与美国国税局提供的Excel工作簿核准的替代形式与1040附表的A,B,C语言,C-的EZ,丁,D – 1级,英,法,中,东南,表格6251(AMT)的联邦收入税的准备, 4952,6781,并与附表乙和L.1040A也有相关的工作表的数量和扣除附表D包括社会保障福利,合格股息和资本收益税,以及儿童税收抵免的工作表。

Tax Assistant for Excel Professional 6.x | 12 MbTax Assistant for Excel is a custom application written for Microsoft Excel and requires Microsoft Excel 97/2000/XP/2003/2007.

It simplifies your Federal Income Tax preparation by providing Excel workbooks with IRS approved substitutes of Form 1040 with Schedules A, B, C, C-EZ, D, D-1, E, L, M, SE, Forms 6251 (AMT), 4952, 6781, and Form 1040A with Schedules B and L.

There are also a number of worksheets related to deductions and Schedule D including the Social Security Benefits, Qualified Dividends and Capital Gain Tax, and Child Tax Credit worksheets.

Your sources of income, deductions, capital gain transactions as well as partnership and S corporation income are entered on separate worksheets.

The data from these worksheets is then automatically entered into the correct forms.

Tax Assistant for Excel helps you determine whether to itemize deductions, automatically calculates your tax and provides a computerized record of your tax filing.

The program also provides an automated Schedule D and D-1 preparation that is especially helpful for active traders and other taxpayers with a large number of trades to report.

The program allows you to easily enter or copy and paste your trades into the Capital Gains sheet and print out a Schedule D attachment as a substitute for preparing multiple Schedule D-1’s, although the program will prepare up to 50 Schedule D-1’s (420 in the professional version).

In addition to the more common income reporting, you can report income from up to five different businesses, rents, royalties, estates and trusts, as well as income from partnerships and S corporations.

The forms provided in Tax Assistant for Excel are accurate reproductions of the actual forms and are approved by the IRS.

While the program will help you with your tax preparation, it does require that you follow some IRS instructions in order to accurately complete your tax return.

If you do not feel comfortable with this approach, you should purchase an interview based tax preparation software package or hire a professional to prepare your tax return.

Even if you use other tax preparation software or a tax professional, Tax Assistant for Excel can provide IRS approved electronic copies of your tax return in the common Microsoft Excel file format for long term storage.

It can also provide an easy way to estimate your taxes based on different scenarios.

–Tax.Assistant.for.Excel.2007.Professional.v5.6.Regged-BLiZZARD.rar:Tax.Assistant.for.Excel.2010.2013.2016.Professional.v5.6.Regged-BLiZZARD.rar: